.jpg?width=3840&height=1200&name=SCH_Website%20Money_Worries_Header_1%20(3).jpg)

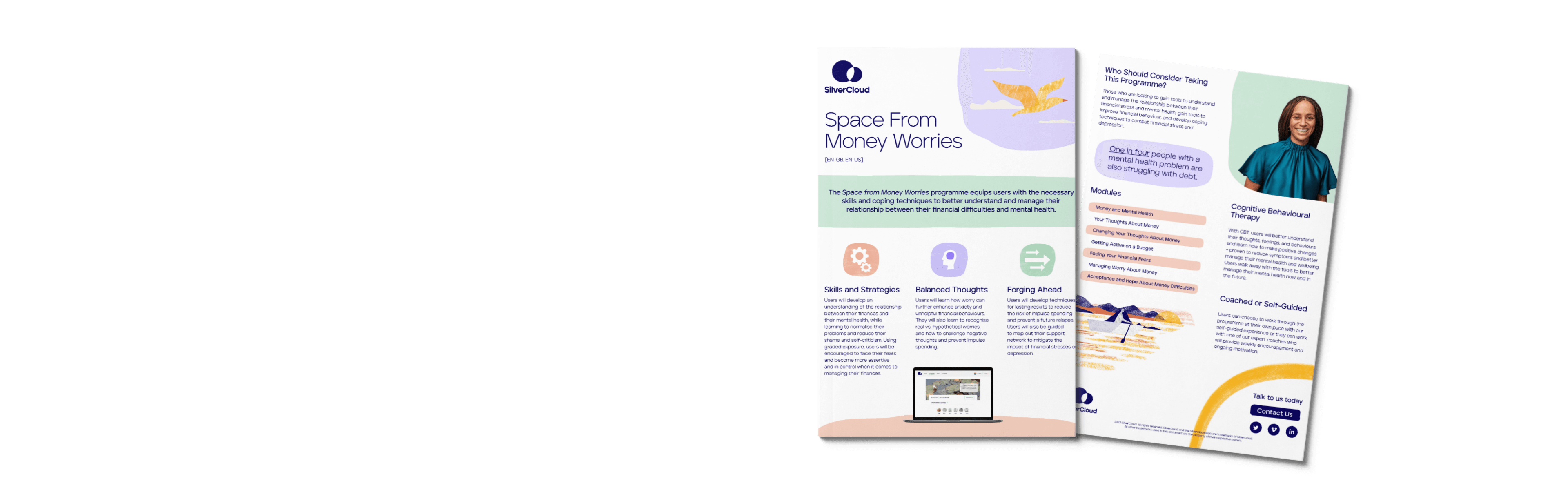

One in four people with a mental health problem are also struggling with debt. Mental health and financial worries can be closely intertwined, creating a cycle of worsening symptoms.

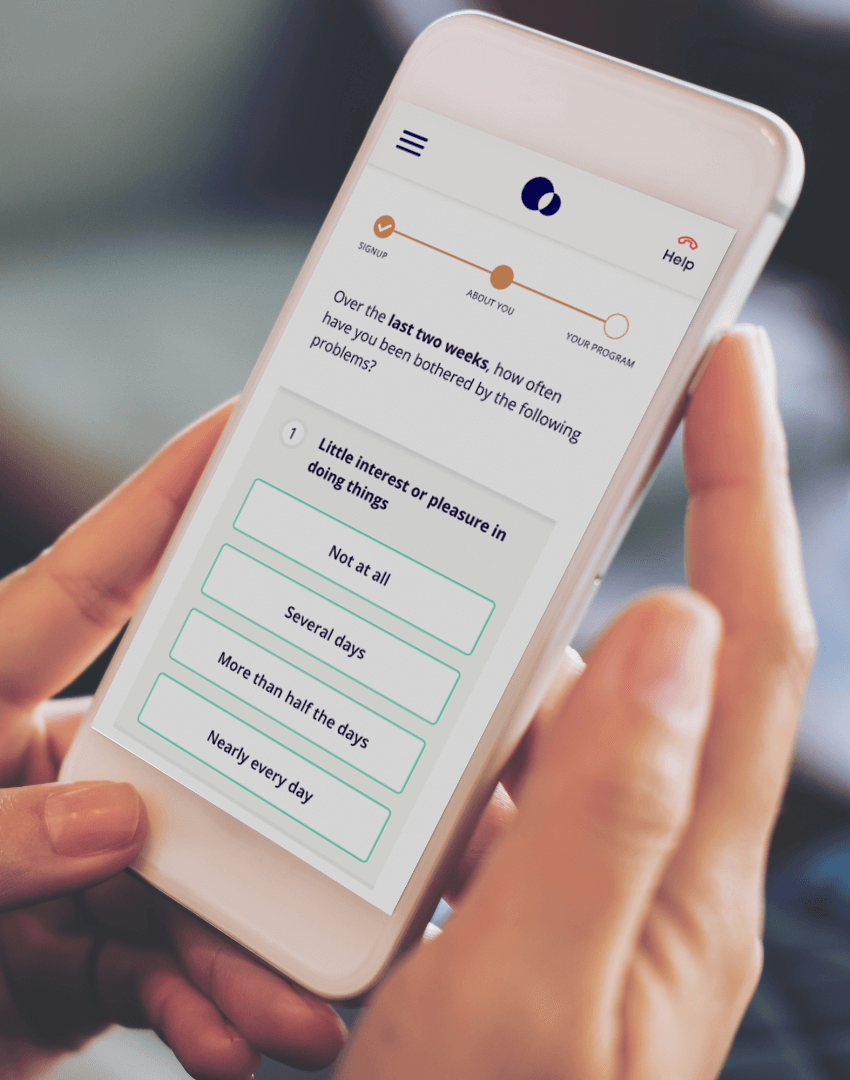

Using Cognitive Behavioural Therapy (CBT), the Money Worries programme helps people understand the relationship between their financial stress and mental health, gain tools to improve financial behaviour, and develop coping techniques to combat financial stress and depression.

SilverCloud® by Amwell® Money Worries programme has been designed to help users better manage and understand their money worries by:

Money Worries Modules:

Getting Control Over Impulsive Spending

Staying Financially Healthy

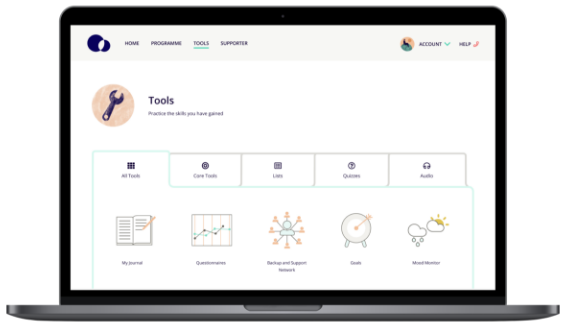

Interactive Tools Include:

We provide both coach-supported and self-guided programmes. Coached programmes provide extra guidance and one on one encouragement to those who need additional motivation. Our self-guided option allows participants to work through programmes at their own pace.

Our CBTalks Podcast covers a wide range of topics, some of which address holistic challenges such as the link between financial difficulties and mental health conditions. In Episode 17 of our podcast, Money Worries, Amwell® sits down with Dr Thomas Richardson, clinical psychologist and accredited Cognitive Behaviour Therapist, to discuss the interrelationship between mental health and financial implications. Further, in order to help individuals discover a healthy balance between the two, SilverCloud® teamed up with Dr Richardson to develop an online-based psychological intervention known as the Space from Money Worries program. Listen to Dr Richardson’s insight and guidance on using CBT to tackle the underlying patterns that link financial and mental health issues here:

Listen to our CBTalks Podcasts Series below:

© 2023 SilverCloud® All Rights Reserved. SilverCloud is a registered trademark of American Well Corporation